Capital Allocation – Factor Strategy

Wish you and your loved ones a Happy Diwali.

In this newsletter, our aim is to elucidate the significance of Capital Allocation.

Markets operate as predictive mechanisms, often anticipating events such as the Federal Reserve’s interest rate hikes. Nevertheless, the extent of these increases was unforeseeable, transitioning from near-zero interest rates to 5% within 18 months, marking a substantial surge.

On October 18, 2021, Indian equity markets reached represented by the BSE 100 a previous peak hit 61,765, and later achieving a historic high of 66,800 on September 20, 2023, resulting in an XIRR of….wait a minute……

4.16%, that’s lower than Fixed Deposits. For those who invested around this period, its been an agonising impatient journey with several other macro factors , wars & geo political challenges adding to the woes.

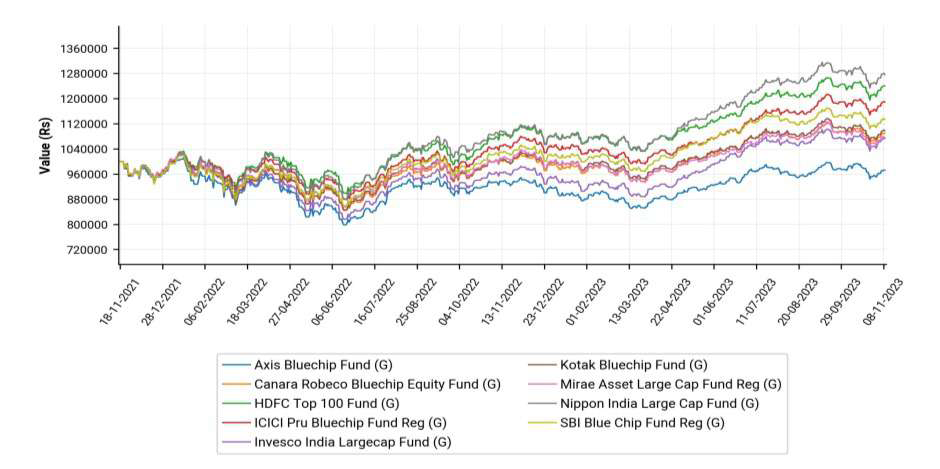

Since October 18, 2021, off the Top 100 companies 46 of them yielded returns below the 4.16% XIRR. If one contends that a 12% weighted average cost of capital is normal, then 52% of companies generated returns below this. 20 large cap companies have delivered an average of negative 30% during this period. This challenging scenario has posed difficulties for even the most skilled fund managers. Examining the performance of some large-cap fund managers.

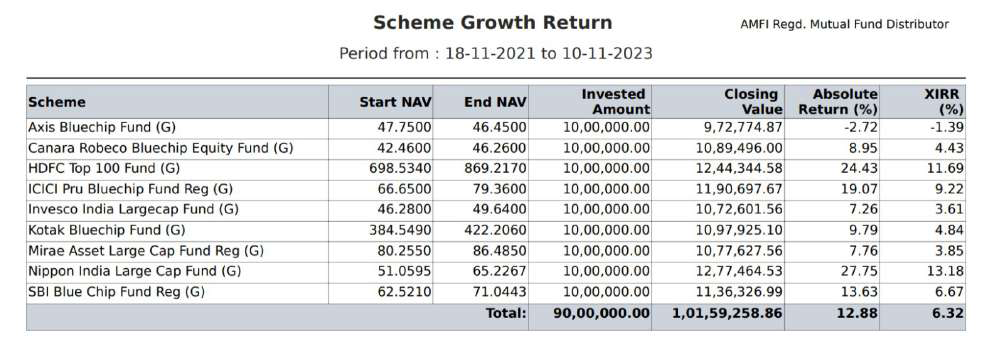

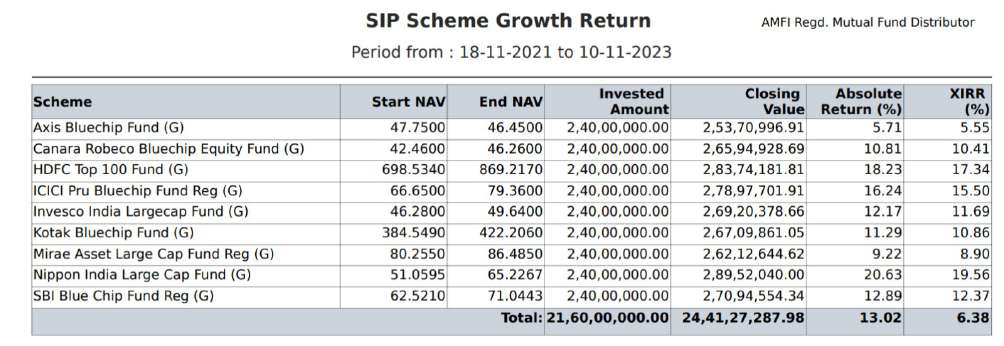

Listed here are some of the large cap fund managers who from time to time have often demonstrated top quartile performance and their performance since 18 October 2021.

Though we are comparing amongst a small but a very critical period, did Investing Systematically Work?

It clearly didn’t…the difference is just 6bps.

The BSE 100, comprising the top 100 companies by market capitalisation, has experienced this trend due to investors favouring high-quality firms in a low-interest-rate environment. Quality is characterised by companies with a High Return on Equity and a consistent delivery of a higher incremental Return on Capital Employed. In a low interest rate environment these firms equity valuations have undergone significant revaluation, with their multiples due to its expansion and not necessarily aligning with their earnings. Despite earnings realisation, a substantial portion of the valuation was already factored in. As these are sizeable companies with ample liquidity, corrections may not occur swiftly, manifesting as time corrections that can be arduous. However as written earlier 20 large companies saw swift price corrections from 18/10/2021. Patience, extending over at least another 2-3 years, is necessary for holding onto these investments before one may start seeing gains above cost of capital.

The companies that delivered the highest returns in this period.

| Top 10 Stocks Contributed Returns |

| Varun Beverages Ltd. |

| Adani Power Ltd. |

| Tube Investments of India Ltd. |

| Trent Ltd. |

| Bank Of Baroda |

| Cholamandalam Investment and Finance Company Ltd. |

| Bharat Electronics Ltd. |

| The Indian Hotels Company Ltd. |

| Coal India Ltd. |

| Max Healthcare Institute Ltd. |

Source : AceEquity.

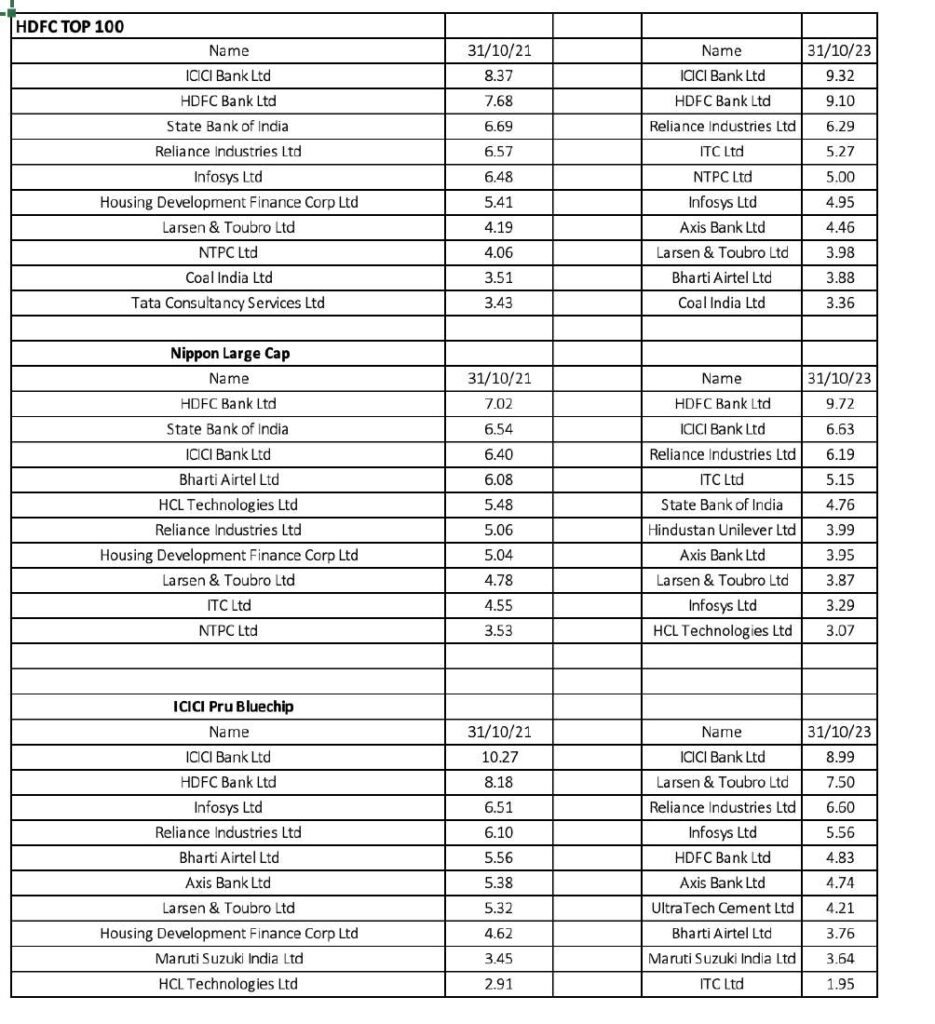

Examining the current composition of the top-performing funds and their Top 10 Stocks, you’ll notice that the majority of these companies are absent from the active bets made by leading funds. This is primarily attributed to the mandates of large-cap funds, which require them to deploy substantial amounts. Moreover, many fund managers replicate the stocks in the index, and the disparities in excess returns are evidently influenced by the selection of stocks and the applied weightage.

Source : Ace Equity, Morningstar, Growthfiniti Wealth Pvt Ltd Research

Obviously while this has been amongst the most difficult period for markets especially when the index has delivered returns much lower than a fixed deposit, what has stood out is Value as a Factor.

Value, as a factor in investing, refers to the strategy of seeking out stocks or assets that are believed to be undervalued or priced lower than their intrinsic worth. Investors employing a value-oriented approach typically look for opportunities where the market has underestimated a company’s true value, considering factors such as earnings, dividends, book value, and other fundamental metrics. This approach contrasts with growth investing, which focuses on companies with the potential for aboveaverage future growth. Since growth companies had already expanded in a low interest regime, Value did very well in a opposite scenario as investors look to book gains and move to low PE stocks.

The strategy of good capital allocators & wealth firms is centred on the efficient deployment of financial resources to optimise returns for a given level of risk. Successful capital allocators possess the ability to assess various investment opportunities, weighing risk and reward factors, and allocating capital where it is likely to yield the highest returns relative to the associated risks. This involves a keen understanding of the market, and industry dynamics and the effectiveness of an underlying asset. Effective capital allocators may reallocate capital based on changing market conditions and strive to optimise the overall portfolio performance, an exercise that can be carried at a defined level of frequency.

Going forward we believe that one style of investing will not work. Diversification across Factors will be a key to compounding.

Happy Investing.

To know more about the Growthfiniti Efficient Frontier and get your portfolio reviewed write to us at info@growthfiniti.com.

Growthfiniti Wealth Pvt Ltd is an AMFI Registered Distributor (ARN168766).

Disclaimer:

Investment in Securities market are subject to market risks, read all the related documents carefully before Investing.

This email and information contained in this email is solely for information purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for any services, securities or other financial instruments. The information contained herein are strictly confidential and are meant solely for the selected recipients and are not meant for public distribution. This email should not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced, duplicated or sold in any form, without prior written consent of Growthfiniti Wealth Pvt Ltd (“GWPL”). In rendering this information, GWPL assumed and has relied upon, without independent verification, the accuracy and completeness of all information that was available to it. While every effort is made to ensure the accuracy and completeness of information contained, GWPL and its affiliates takes no guarantee and assumes no liability for any inadvertent errors or omissions in the information contained in this email. This information is given in good faith and we make no representations or warranties, express or implied as to the accuracy or completeness of the information. No one can use the information as the basis for any claim, demand or cause of action. This email is not an investment advice and must not alone be taken as the basis for an investment decision. Investments in securities are risky asset class and are subject to market risks including, without limitation, price, volatility and liquidity risks. The recipient may take their own decisions based on their specific investment objectives and financial position and using such independent advisors, as they believe necessary. The recipient should independently evaluate the investment risks and should make such investigations, as it deems necessary to arrive at investment decision and should consult their own advisors to determine the merits and risks of an investment decision. GWPL and its affiliates, any of its directors, officers and employees shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this information in any manner whatsoever. The recipient assumes the entire risk of any use made of this information. GWPL & its affiliates may have used the information set forth herein before publication. GWPL takes no responsibility of updating any data/information mentioned herein from time to time. This information is not directed or intended for distribution to, or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject GWPL and/or its affiliated company (ies) to any registration or licensing requirement within such jurisdiction. Persons in whose possession this information may come, are required to inform themselves of and to observe such restrictions. Growthfiniti Wealth Pvt Ltd Limited. CIN: U65990MH2019PTC334051 www.growthfiniti.com